Reducing Concentration Risk with a Diversified Portfolio Aligned with Investors’ Values

The Portfolio Managers of the Hennessy Stance ESG ETF discussed concentration risk in the S&P 500 Index, portfolio changes and the case for sustainable investing.

-

Bill DavisPortfolio Manager

Bill DavisPortfolio Manager -

Kyle BalkissoonPortfolio Manager

Kyle BalkissoonPortfolio Manager

Information about the Hennessy Stance ESG ETF (the “Fund”), a semi-transparent actively managed exchange-traded fund ("ETF") with a Portfolio Reference Basket structure:

The Fund is different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day. The Fund will not. This may create additional risks for your investment. For example:

- You may have to pay more money to trade the Fund’s shares. The Fund will provide less information to traders, who tend to charge more for trades when they have less information.

- The price you pay to buy Fund shares on an exchange may not match the value of the fund’s portfolio. The same is true when you sell shares. These price differences may be greater for the Fund compared to other ETFs because it provides less information to traders.

- These additional risks may be even greater in bad or uncertain market conditions.

- The Fund will publish on its website each day a “Portfolio Reference Basket” designed to help trading in shares of the Fund. While the Portfolio Reference Basket includes all the names of the Fund’s holdings, it is not the Fund’s actual portfolio.

The differences between the Fund and other ETFs may also have advantages. By keeping certain information about the Fund portfolio secret, the Fund may face less risk that other traders can predict or copy its investment strategy. This may improve the Fund’s performance. If other traders are able to copy or predict the Fund’s investment strategy, however, this may hurt the Fund’s performance.

For additional information regarding the unique attributes and risks of the Fund, see the Prospectus and SAI.

Key Takeaways

» With the S&P 500 Index becoming more concentrated in a few mega-cap technology companies, portfolio diversification becomes more important.

» The ETF has 35 holdings across nine sectors, offering diversification while aligning capital alongside investors’ values.

» Regardless of the federal adminstration, we believe that companies will continue their sustainability initiatives.

» The drivers of sustainable investing appear intact as investors continue to seek better risk-adjusted returns through an investment that aligns their capital with their values.

What are your thoughts on the increased concentration risk in the S&P 500® Index?

Due to the performance of a few mega-cap technology stocks over the past few years, the S&P 500® Index has become more concentrated. As of the end of 2024, the top 10 companies in the Index by cap weight account for 37% of the overall index. Conversely, the 10 smallest companies collectively make up 1%. In other words, investors who purchase a fund that tracks the performance of the S&P 500 appear to be making a bet on the continuance of the outperformance of a handful of mega cap names.

To be sure, over the past few years, an investment in the S&P 500 would have done well. However, this trend hasn’t always been the case. In fact, since its inception at the beginning of 1990 through the end of 2024, the S&P 500 Equal Weight Index has outperformed its market cap-weighted counterpart by 0.51% on an annualized basis.

While it is unknown when performance leadership in the S&P 500 may change, we believe investors should make sure to maintain a diversified portfolio to reduce this concentration risk.

Would you please discuss the Fund’s diversified portfolio after its quarterly rebalance?

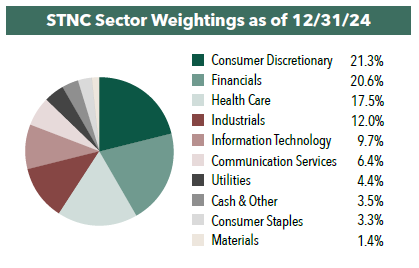

The ETF is a diversified portfolio of 35 stocks across nine of the 11 S&P 500 sectors as of December 31, 2024. The portfolio holds no Energy companies as these businesses do not often meet our investment criteria.

As of the beginning of 2025, the largest sector weighting was in Consumer Discretionary, followed by Financials and Health Care.

In terms of individual holdings, a few examples of new names to the portfolio in the fourth quarter of 2024 include Wells Fargo & Co., Deere & Co., and PACCAR Inc. We believe these additions reflect a greater focus on well-run smaller-cap Industrial companies and Financials stocks.

What are the challenges and opportunities for the future of sustainable investing with the incoming presidential administration?

With the new administration, there could be a reduced focus on climate initiatives. For example, the administration announced the U.S. would withdraw from the Paris Agreement, the international treaty on climate change. However, since then, 24 U.S. state governors pledged to continue to work to achieve the goals of the Agreement to reduce greenhouse gases.

Regardless of who is in the White House, we believe that companies will continue their sustainability initiatives. Many companies believe that achieving their environmental, social and governance goals will result in direct benefits to their businesses, and that investors will reward those efforts.

What is your investment case for sustainable companies over the next year?

Our investment case is unwavering. We seek to invest in the best-managed and governed companies in each industry and sub-industry group. Part of that calculus relates to how businesses manage offbalance sheet risks relating to environment and societal obligations.

Importantly, we believe the drivers of sustainable investing remain intact as investors continue to seek better risk-adjusted returns through an investment that aligns their capital with their values.

- In this article:

- Stance ESG ETF